does nevada have an inheritance tax

But your inheritance can still become subject to federal estate taxation. An estate that exceeds the Federal Estate Tax Exemption of 1206.

How Large Of An Estate Can Pass Federal Estate Tax Free In Nevada

It means that in most cases you wont be responsible for any tax due if you inherit property in Nevada.

. Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut has the highest exemption level at 71 million. This is a tax that is assessed when beneficiaries receive. Inheritance tax rates differ by the state.

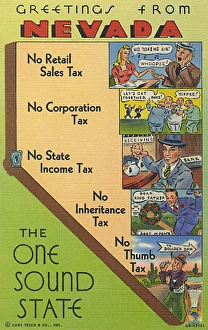

No Nevada does not apply an inheritance or estate tax. As of 2021 the six states that charge an inheritance tax are. These states have an inheritance tax.

Select Popular Legal Forms Packages of Any Category. It means that in most cases you wont be responsible for any tax due if you inherit property in Nevada. Of the six states with inheritance.

Thats why Nevada is such a tax friendly state. Nevada generally is a tax-friendly state there are some incomes. Nevada also does not have a local estate tax.

Income Tax Rate Range. Nevada does not levy an inheritance tax. Does Nevada Have an Inheritance or Estate Tax.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any. The federal government IRS may impose an inheritance tax is the value of the deceased persons entire estate is over 55 million as of. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax.

For instance in Kentucky inheritance tax is paid where you inherit a property situated there. How Much Is the Inheritance Tax. Inheritance and Estate Tax Rate Range.

However estates valued above 1206 million in 2022 are subject to a federal. Property Tax Rate Range. Property Tax In Southern Nevada is about 1 or less of the propertys value.

Thats why Nevada is such a tax friendly state. Nevada does not have an inheritance tax. The top inheritance tax rate is 16 percent no exemption threshold New Mexico.

But taxes are just one element of. Who has to pay. Heres a breakdown of each states inheritance tax rate ranges.

The good news also is that the IRS does not impose an inheritance tax. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on.

Nevada Retirement Tax Friendliness Smartasset

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

2015 Estate Planning Update Helsell Fetterman

Estate Tax Probate Estate Planning Attorneys In Las Vegas Nv

Prince Will Pay Millions In Death Tax

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Nevada Tax Advantages And Benefits Retirebetternow Com

Sisolak Silent On Federal Gas Tax Issue Serving Northern Nevada

Does Your State Have An Estate Or Inheritance Tax

How Large Of An Estate Can Pass Federal Estate Tax Free In Nevada

Nevada Policy Here S A Quick Reminder Of Where We Come From As A State Facebook

State Estate And Inheritance Taxes Itep

States With No Estate Or Inheritance Taxes

Nevada Inheritance Laws What You Should Know

The Property Tax Inheritance Exclusion

Greetings From Nevada Usa The One Sound State No Photos Prints Framed 14128753

Vintage Las Vegas Nevada State Line 1947 A Debt Free State Welcomes You Hwy 91 At Today S Primm Nv If You Wonder Why Signs Like This Don T Survive Note The Bullet Holes

Nevada State Line A Debt Free State Welcomes You Debt Free Free State Nevada State